Download file or scroll down

Whitepaper

Fit for Growth: Best Practice Guide to Streamline your Financial Close with CCH® Tagetik

Preface

Fast-growing companies ultimately face the same challenge:

how to manage financial data with increasing scope and complexity

When it comes to the group financial close and consolidation, many fast-growing companies are facing similar challenges:

- Increasing complexity of the legal structure, especially with inorganic growth, e.g. through mergers, acquisitions, joint-ventures, or other investments

- Increasing regulatory requirements, e.g. corporate tax, IFRS notes, or fair value measurements

- Increasing information demands from owners and management, e.g. profit/cost center breakdown, organic vs. inorganic growth, business area reporting

In the face of such challenges, it often becomes apparent that legacy systems (or in some cases Excel) are inadequate to master them.

This whitepaper outlines:

- Typical shortcomings of legacy financial close and consolidation systems

- Time-tested Best Practices along the financial record-to-report process

- Easy-to-use solutions provided by the CCH® Tagetik platform

These outlines are aimed at helping the finance function to improve its ability to provide quick and well-founded information and analysis to the business.

1

Speed & Effort

3Data Quality

3

Harmonizing the Group Chart of Accounts (CoA)

4Centralizing the ERP system landscape

4Collecting details at the source

4

Data collection

5Monitoring

5IC Matching

5Consolidation

5Costumization

6Visualization

6Scenario reporting

6Validations

6Automation

6Disclosure

6Modular expansion

6Scalability

6

2

1. Typical issues with legacy consolidation systems

Financial close and consolidation systems typically have shortcomings in three areas:

speed & effort, data quality and flexibility

Speed & Effort

Any functionality that a financial close and consolidation system lacks must be compensated for by manual workarounds and data preparation. Such detours can significantly increase expenses in the finance department, and potentially jeopardize the closing deadline.

For example, if a system cannot recognize and process intercompany relationships within the group, the task of identifying and matching them by checking the general ledgers of various different ERP systems can be colossal, resulting in significant man hours spent and potential delays in the financial close.

Data Quality

Data quality issues typically have two main reasons: the data lacks detail and/or is incorrect.

Lack of detail means that certain data from source systems (ERP or other) is not imported or processed in the close and consolidation system, preventing any direct analysis in detail reports or via drill-down.

Incorrect data on the other hand can be obfuscated by lack of detail as described above. Incorrect data is typically generated at the source, i.e. in the local accounting or other source systems. This can result in erroneous disclosures, inexplicable differences, or unplausible data. Below certain thresholds, such cases may be accepted by the auditor, but can cause significant issues if ignored in the long run.

Flexibility

Growing companies require flexibility in their financial close and consolidation systems to fulfill the demands from different stakeholders, such as management, owners, and auditors. For example:

- The acquisition of a sub-group in a foreign country requires a parallel sub-consolidation scenario with a different currency translation method and accounting standards

- A management decision to change or add business dimensions, such as a reorganization of business segments, requires the adaption of data and reporting structures

- Management, owners or auditors request detailed ad-hoc information reports

Such requests can bring legacy systems to their limits if they do not provide appropriate flexibility.

3

2. Organizational Best Practices for the Financial Close

Certain organizational Best Practices have shown to improve the above described

shortcomings, independent of the close and consolidation system

Although some of the previously mentioned shortcomings can be compensated for by features in the close and consolidation system, as described later in this whitepaper, there are certain best practices that improve the reporting process regardless.

These best practices include:

Harmonizing the Group Chart of Accounts (CoA)

Harmonizing the CoA across the group improves both efficiency and data quality, because it facilitates the aggregation and comparison of data. If this is not feasible, a structured mapping process in the responsibility of the local companies in alignment with the group, may be a fitting alternative. If local reporting in a difference CoA and accounting standard is legally required, it is possible to convert data in the local system retrospectively, in order to not impede the group consolidation process.

Centralizing the ERP system landscape

Integrating local companies’ ERP systems in one central ERP system drastically improves speed by facilitating harmonization, increasing flexibility and reducing maintenance, because changes can be applied to all included subsidiaries at once. Admittedly, ERP-related projects tend to be significant in scope. Therefore, when considering the consolidation of ERP systems various factors and trade-offs must be considered, such as the time-horizon a company is expected to stay within the group.

Collecting details at the source

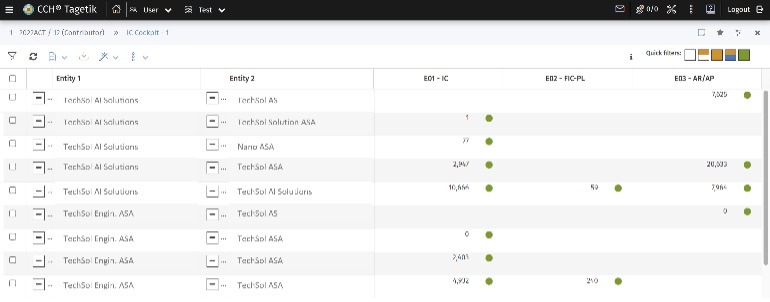

Collecting as much information at the source, i.e. where the transactions occur, as reasonably possible facilitates the automation of later closing and consolidation tasks. This requires first of all to import general ledger (GL) data instead of merely trial balances (TB). General ledger transactions can subsequently be enriched by helpful details such as intercompany (IC) partners and transaction types. The IC partner information enables swift matching and elimination of IC transactions. The transaction types on the other hand can be used to automatically generate notes tables such as the change in assets or change in equity tables. Furthermore, they can enable the automatic generation of the cash flow statement, if cash/non-cash transactions can be separated by type. To collect such detailed information consistently, strong governance processes and/or mandatory fields in the source systems may be helpful.

4

3. Financial Close in CCH® Tagetik

CCH® Tagetik’s features enable a quick, flexible, and detailed close and consolidation process

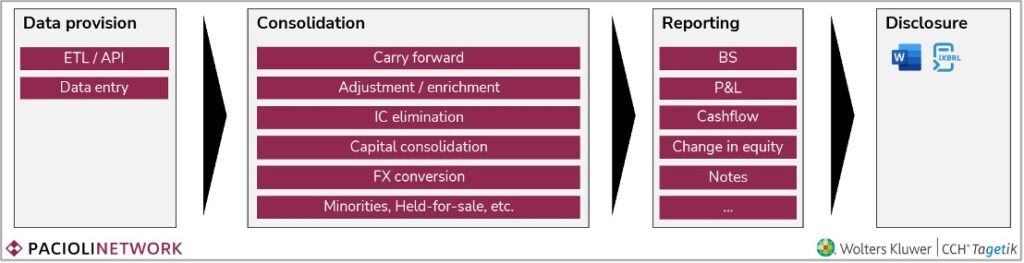

With CCH® Tagetik, the Financial Close and Consolidation process can be streamlined end-to-end: from data collection, through data processing and consolidation to reporting and disclosure.

Date collection

CCH® Tagetik’s ETL module allows establishing quick and flexible connections with different source systems, both via file upload or automated programming interface (API).Monitoring

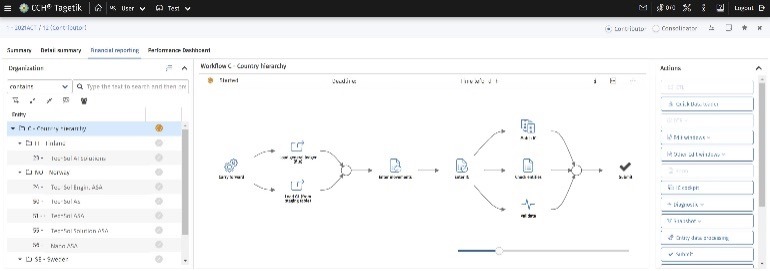

At the heart of CCH® Tagetik lies its process monitoring cockpit, which allows a large number of users across the group to work in their own, customized workflows according to their rights and responsibilities, including steering of deadlines, approvals, and more.

IC Matching

Another central component is the IC matching cockpit, which allows the matching, confirmation and approval of IC transactions across the group for seamless elimination.

Consolidation

The consolidation engine is one of the original core components of CCH® Tagetik. After years of usage and improvement, it comprises a vast repertoire of standard close and consolidation functionalities out of the box, i.e. the system knows how to consolidate before it is implemented.

5

Such functionalities include:

- Various consolidation cases for fully-owned, associated, or joint venture companies

- Multiple currencies including parallel consolidation scenarios

- Multi-GAAP reporting

- Various IFRS cases, e.g. for IFRS 3, 5, 9, 16

Customization

CCH® Tagetik is highly customizable to your unique company structure, e.g. regarding:

- Chart of Accounts

- Entity and ownership structure

- Business structure (business area, cost center)

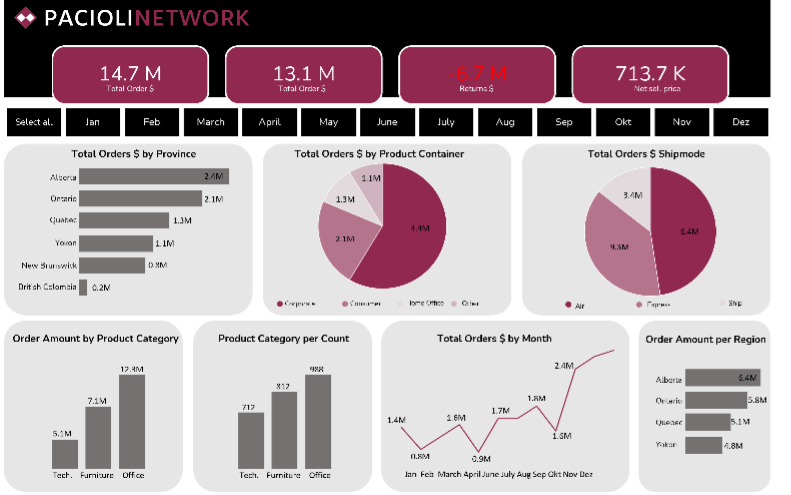

Visualization

CCH® Tagetik’s Excel-add-in allows building dynamic reports making full use of Excel’s functionalities. Integration with visualization tools such as Power BI is an additional option.

Scenario reporting

Through a combination of consolidation scenarios and data layers, diverse sub-group consolidations can be generated with different currencies, accounting standards, and consolidation scopes.

Validations

In CCH® Tagetik, data can be validated both during the import/entry or during the closing process with detailed technical plausibility checks.

Automation

Group or other postings that follow a specific rule (e.g. netting of certain positions), can be quickly automated with calculation logics.

Disclosure

In addition to Excel, CCH® Tagetik can be integrated with Word (and even iXBRL) for a semi-automated creation of disclosure documents.

Modular expansion

Besides Consolidation, other modules of the CCH® Tagetik platform can be seamlessly integrated, such as for Planning, Forecasting, or various other regulatory and tax compliance tools.

Scalability

Due to its inbuilt standard functionalities and despite its relatively low setup costs, the CCH® Tagetik platform is highly scalable, which is why multinational companies such as the Daimler Group in Germany or Alcatel-Lucent in France use it. To learn more about the CCH® Tagetik platform, visit:

6

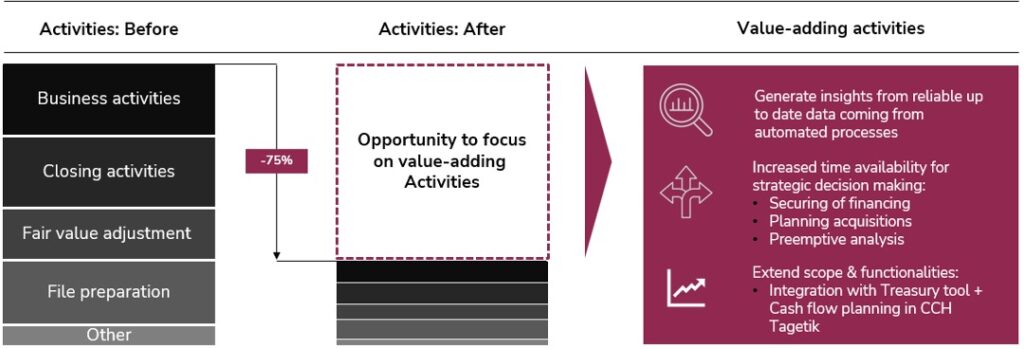

4. Customer example

Meet one of our customers, who reduced their time & effort for the quarter close by 75%

One of our 100+ clients, KMC Properties ASA, a Norwegian real estate group, faced challenges with its financial close and consolidation process, heavily relying on manual Excel workarounds. To combat the issues, we have adopted the CCH® Tagetik platform, which streamlined their financial process, automating many tasks and significantly enhancing data quality.

As a result, not only did they witness a significant reduction in time and effort, but they also saw improved transparency and analytical capabilities, empowering the accounting team to better contribute to the company’s financing and M&A activities.

I am saving so much time, and data

quality is on a completely new level!

7

5. The Pacioli Network

The Pacioli Network is uniquely positioned to help you get the most out of CCH® Tagetik

Implementing a close and consolidation system without real experts is like trying to build a house with the finest materials but lacking an experienced architect; despite having superior resources, achieving success becomes an elusive goal. Early design errors can lead to significant future efforts and hinder the system’s scalability, undermining the inherent advantages of the system.

You will not face this predicament working together with the Pacioli Network.

The Pacioli Network is a global network of CCH® Tagetik consultants. Due to a number of factors, the Pacioli Network is in a unique position to deliver optimal results:

- Our consultants have up to decades of experience with CCH® Tagetik and cover all modules of the platform; they have completed implementations at well over 100 companies

- Our super-lean organization structure offers maximal benefit to you and incentives to the consultants to deliver their best

- Our large pool of professionals offers you resource security and flexibility to ensure timely delivery

8

6. Conclusion

Prepare your Finance Organization for Growth with CCH® Tagetik

In this whitepaper, we addressed common finance challenges faced by rapidly growing companies due to increased complexity. These challenges often stem from shortcomings in legacy financial close and consolidation systems, specifically in speed, data quality, and flexibility.

While certain organizational practices can help, a robust consolidation solution is essential for efficient closing processes. CCH® Tagetik offers a comprehensive platform covering the entire process from data collection to financial disclosure.

The Pacioli Network, with its seasoned experts, ensures CCH® Tagetik’s full potential is realized. For instance, KMC Properties ASA reduced quarter-close time and effort by 75%, enhancing data quality and transparency to support strategic objectives.

In conclusion, implementing CCH® Tagetik with the Pacioli Network prepares your finance organization for growth and adaptability in an ever-changing business landscape.

9

Contact us

Leverage the possibilities of CCH® Tagetik with the Pacioli Network

Do you have questions?

Contact us contact@pacioli-network.com or reach out to me directly to analyze the potential in your organization for streamlining your closing and consolidation process with CCH® Tagetik.

William Markus

Managing Partner

Email: contact@pacioli-network.com

10