How Tomra Systems ASA Leverages Business Unit Consolidation in a 2-Phased Financial Close

Company & Initial situation

Tomra Systems ASA (TOMRA) is a Norwegian multinational corporation specializing in sensor-based solutions for resource optimization, including reverse vending machines and sorting systems for recycling, food processing, and mining. Founded in 1972, it operates globally with over 105,000 installations across more than 100 markets, promoting a circular economy and sustainability.

For a long time, TOMRA has been growing consistently whilst expanding across multiple regions and business units. After years of rapid development, TOMRA’s finance function started to reach its limits, due to constraints of its legacy consolidation system, specifically regarding scalability and flexibility.

As a consequence, TOMRA was looking for a state-of-the-art Enterprise Performance Management (EPM) solution to replace it, aiming to integrate in one platform:

- Legal consolidation and reporting

- Management reporting

- Budgeting & planning

- IFRS16 calculation and adjustments

- ESG reporting

Further critical requirements were adopting group-wide reporting best practices and enabling the internal finance team to manage and maintain the system independently.

Solution

TOMRA implemented CCH® Tagetik as a central, scalable finance platform for legal and management reporting. Although several CCH® Tagetik modules have been implemented, this article focuses on the consolidation and reporting module.

Regarding consolidation and reporting, the new solution streamlined processes from data collection to output reporting, incorporating all of the typical components of a consolidation solution:

- Data collection and harmonization

- GAAP adjustments (incl. integration of IFRS16 adjustments)

- Other automatic adjustments, such as netting of cash and certain receivables/payables

- FX (foreign exchange) rate conversion & FX reserve calculation (incl. historical)

- Intercompany (IC) matching and elimination

- Investment in subsidiaries elimination

- Non-controlling interest reclassification

Furthermore, TOMRA was able to address its more unique requirements leveraging CCH® Tagetik’s inbuilt functionalities. Two such requirements are

- Annual reporting in 2 phases – month-end vs. year-end close

- Business unit consolidation for improved performance reporting

1. Annual reporting in 2 phases – month-end vs. year-end close

In addition to the regular month-end closing, TOMRA established a separate year-end closing phase in order to provide updated data and additional information after the initial month-end management reporting is completed.

The two phases comprise:

1. Month-end:

- Intercompany data import and matching

- Gross data import and adjustments (balance sheet, P&L, cash flow)

- Consolidation

2. Year-end:

- Intercompany data update and matching

- Gross data update and adjustments

- Consolidation

- Further detail information (e.g. maturities of loans)

- Statistical data (e.g. number of employees)

To keep this phased process as simple as possible for the users and without redundancy of data, TOMRA decided to leverage CCH® Tagetik’s category model.

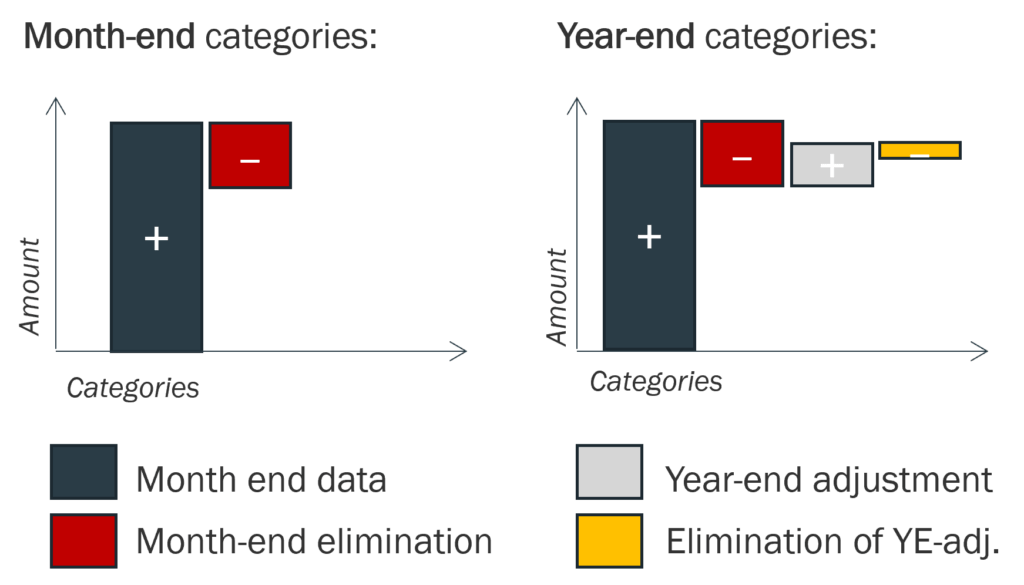

In CCH® Tagetik, categories act as data layers, organizing data types. TOMRA used categories to differentiate data types both within and between the month-end and year-end closing phases.

Categories in the month-end phase include:

- Original data, GAAP and other adjustments (visualized as “month-end data” in illustration 1)

- Eliminations (“month-end eliminations”)

The year-end categories further include year-end deltas for all month-end categories, as well as the resulting additional eliminations (visualized as “year-end adjustment” and “elimination of YE-adj.” respectively.) In short, the year-end categories contain the difference between the month-end figures and the year-end figures. In the reporting, these categories provide the flexibility to display the annual data before or after year-end adjustments.

This approach further makes very transparent, which changes have occurred in annual close vs. the month close.

The CCH® Tagetik data model is set up in a way to maximize efficiency by simplifying the data provision process for the reporting legal entities. For example, the group’s legal entities can simply reload the data from their ERP system in the year-end phase, and CCH® Tagetik automatically detects the differences to the month-end process and posts them on the designated delta categories.

2. Business unit consolidation for improved performance reporting

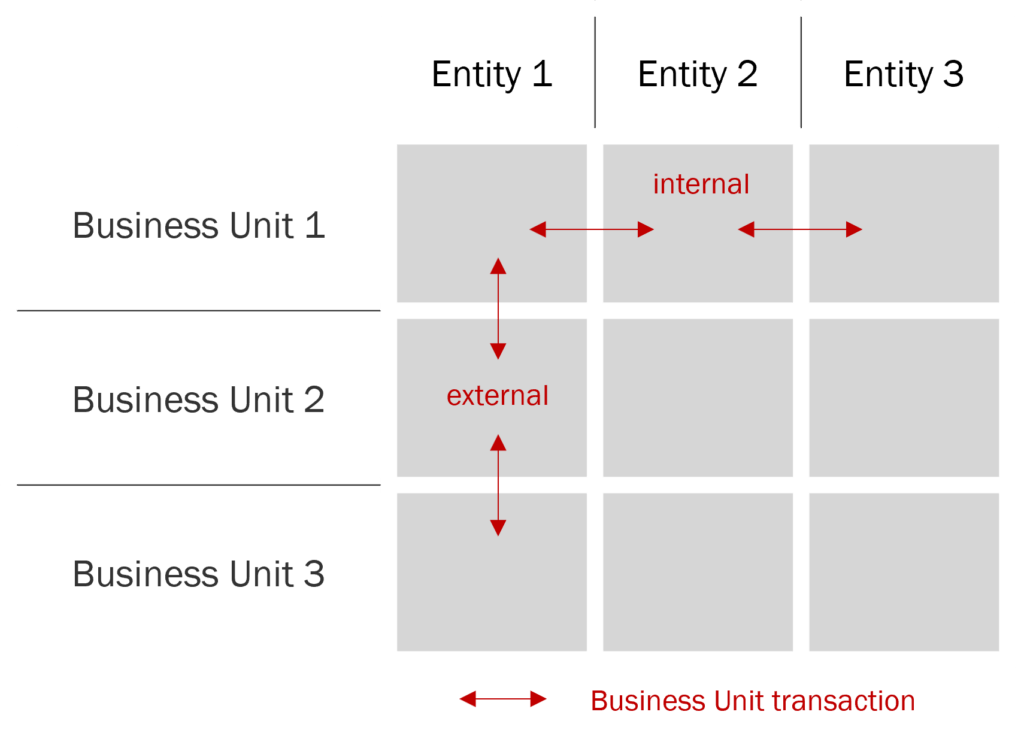

Business units are a cornerstone of TOMRA’s business model and performance management strategy, making accurate reporting of their activities essential. Business units operate independently from legal entities, meaning a single legal entity may encompass multiple business units, or a single business unit may span across several legal entities. To gain a clear and precise view of each business unit’s performance, TOMRA sought to report on business units as if they were standalone entities by eliminating internal transactions within each business unit.

In a standard consolidation process, intercompany transactions between legal entities—such as internal income, expenses, receivables, payables, or investments—are identified and eliminated. TOMRA extended this approach to its business units, enabling a multi-dimensional consolidation. This was achieved by tagging transactions with both legal entity and business unit counterparties. As shown in Illustration 2, this allowed TOMRA to distinguish between “internal” transactions (within the same business unit, such as between the different entities of Business Unit 1) and “external” transactions (between different business units, such as Business Unit 1 and Business Unit 2), ensuring accurate elimination of internal business unit transactions while preserving external ones.

This approach enabled TOMRA to report on individual business units with greater accuracy, treating transactions with other business units as external while eliminating those within the same unit. The same principle applied to larger aggregations, such as divisions of business units. For instance, a division could be reported as a standalone entity by eliminating transactions between business units within that division, while retaining transactions with business units in other divisions.

This powerful multi-dimensional consolidation capability is a standard feature of CCH® Tagetik, empowering TOMRA to achieve a more granular and accurate view of its business performance across all levels of its organizational structure.

Result

As a result of implementing CCH® Tagetik, TOMRA was able to enhance data quality and streamline financial processes, all while the group was growing steadily. A small finance team can now manage the system, and therefore TOMRA’s financial reporting, efficiently and independently – without relying extensively on external consultants.

Client feedback

Maria Heemskerk

VP Head of Group Accounting

Tomra Systems ASA

“We transitioned to Tagetik from Cognos, and the difference has been remarkable. Tagetik’s flexibility allows us to adapt to our growing and changing business structure, significantly reducing manual work. The built-in validations and intercompany matching features have streamlined our consolidation process, saving us time and effort. William and the team have been very responsive and dedicated, even working weekends to resolve critical issues during our annual close. Their coaching approach provides us tailored solutions enabling us to take full control of the solution.”