Financial Consolidation and Equity Method Application at Klaveness Marine Holding AS

Client

Klaveness Marine Holding AS (Klaveness Marine Holding) is a Norwegian investment company specializing in long-term investments across shipping, real estate, and financial sectors. The company manages a portfolio of fully owned subsidiaries, as well as stakes in associated companies and joint ventures.

Initial situation / Problem

As Klaveness Marine Holding grew, its organizational structure and financial consolidation processes became increasingly complex. The company’s reliance on Microsoft Excel and other tools proved inadequate, prompting the need for a modern consolidation solution. The objectives were clear

- Seamlessly integrate and process financial data

- Automate manual tasks to enhance data accuracy

- Efficiently produce and report financial information

The aim was a scalable, robust system to meet both current and future regulatory and shareholder requirements.

Solution

Klaveness Marine Holding partnered with the Pacioli Network to implement CCH® Tagetik, a state-of-the-art tool designed to streamline group financial reporting. The solution addressed two key areas: consolidation of full subsidiaries and application of the equity method for associated companies and joint ventures.

Consolidation of Full Subsidiaries

For full subsidiaries, typically with an ownership of 50%–100%, CCH® Tagetik fully consolidates financial statements by aggregating data and eliminating intercompany transactions. General ledger data from the central ERP system (Xledger) is imported via ETL, then processed based on the Ownership Structure Register (OSR) and predefined consolidation rules. Key automated features include:

- Foreign currency conversion

- Intercompany and financial investment eliminations

- Reclassification of non-controlling interests

- Other automations, e.g. for netting or reclassification

- Journal entries for group-specific adjustments

Consolidation of Associated Companies and Joint Ventures (Equity Method)

For associated companies and joint ventures, typically with an ownership between 20%–50%, the equity method is applied instead of full consolidation. This method records the investment at cost, then adjusts its value based on the investor’s share of the company’s profits, losses, dividends, and other equity changes. Excess values are identified and depreciated as needed, offering a more accurate reflection of the investment’s value on the group’s balance sheet.

To support this process, CCH® Tagetik allows for the provision of all relevant information through several avenues:

- Ownership Structure Register (OSR) for the registration of ownership events including

- Investment, equity, and excess values at acquisition

- Change in shares

- Other events

- Depreciation proposals for

- Depreciation schedules for excess values

- Equity data entry form (for associated companies and joint ventures) to enter

- Profit or loss

- Dividends

- Reserve changes

- Capital increase or decrease

- Journals for

- Write-downs

- Other group-specific changes

Based on the provided information, CCH® Tagetik applies the equity method in 5 steps:

| Equity Method Step | Based on |

|---|---|

| Elimination of the investment | OSR |

| Revaluation of the investment (adjusted) | Equity data entry, OSR (e.g. change in shares) |

| Posting of excess values | OSR |

| Depreciation of excess values | Depreciation proposals |

| Write-downs, if applicable | Journals |

Note that all of these steps include adjustments due to foreign exchange (FX) conversion, which are an integral part of CCH® Tagetik’s consolidation module.

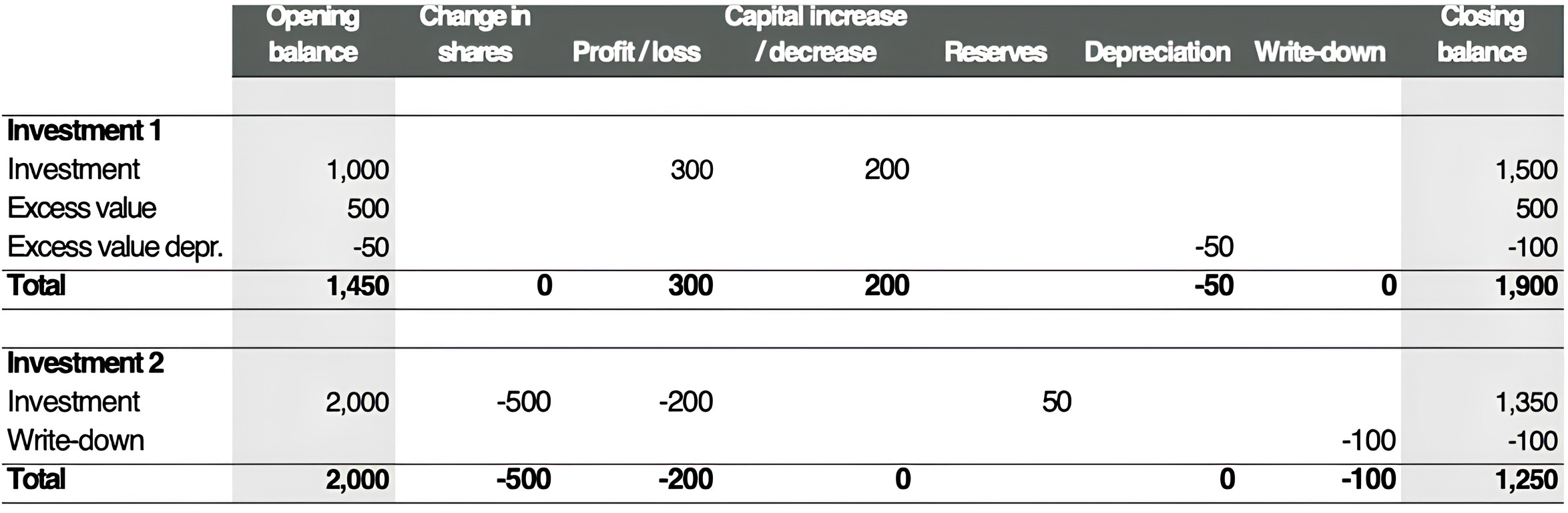

Based on the input and data processing, CCH® Tagetik breaks down the development of each investment in detailed reports. For example, the change of the investments during the year, i.e. from opening to closing balance, including change in shares, profit or loss, and others:

Illustration 1 Exemplary report showing the development of at-equity investments

In other reports, the available information is aggregated and displayed in different ways for group-wide insights.

Result

The implementation of CCH® Tagetik transformed Klaveness Marine Holding’s financial consolidation process. The company now benefits from a scalable solution that ensures high data accuracy and compliance with regulatory standards. Financial reporting is faster and more reliable, providing stakeholders with clear, actionable insights. The equity method application has improved visibility into associated companies and joint ventures, enhancing strategic decision-making. With this solution, Klaveness Marine Holding is well-equipped to support its growth and meet future demands effectively.